Long story short, there has been quite an upturn in the world of Canadian shareholders. It looks like Apollo Global Management Inc. has done the procedures necessary to acquire Canadian Gaming Corp. While the acquisition still stands in the realm of mere possibility, it is undeniably plausible.

And if that’s the case, there are numerous implications for the Canadian gaming scene. Great Canadian owns 26 gambling facilities, so a change of ownership (and so far, a change in shareholders) might impact the field.

How it all began

Apollo Inc has been negotiating with Great Canadian shareholders for a long time. In late December 2020, it increased its offer by 15% – as such, the share price skyrocketed to C$45. The proposal was more than enough to block several shareholders against a possible merger between the two companies. However, the vote hasn’t been decided yet, and advisory firms suggest that Great Canadians vote against the deal.

Where does Great Canadian stand right now?

GC Gaming is a company with a history spanning several decades – it began activity in 1982. After ten years of tenure, it entered the Canuck stock markets, eventually registering with the Toronto Stock Exchange in 2004. Almost 10,000 people found employment under this firm’s management.

Now, it manages 26 premises all over the Federation: out of these, we’ve got to mention the Elements Casino chain. It’s got locations in Surrey, Chilliwack, Grand River, Mohawk, and that’s not even the end of it. Elements Casino advertises itself as the only four-diamond resort in Canada. It also offers hotel service and multiple leisure activities besides gambling possibilities. These characteristics caught the attention of Apollo, which is a global investment organization.

Apollo Global Management Inc. Won shareholder approval for its US$1.9 billion takeover of Great Canadian Gaming Corp., sealing a deal that had faced stiff opposition until the private equity firm increased its bid by 15 per cent. Holders of 79 per cent of the shares voted at a special meeting were in favor of the transaction, executives said on a webcast. Apollo said its acquisition of the casino operator will help it grow its business since it will have more long-term financial flexibility as a privately held company. Great Canadian was founded in 1982. The company operates 26 casinos and hospitality facilities in British Columbia, New Brunswick, Nova Scotia, and Ontario.

Although the GC’s CEO states that the company has an excellent financial standing, the vote might incline towards Apollo taking over Great Canadian.

Casino directories

Corporate mergers represent ambiguous situations – while some firms that have changed ownership will maintain a similar or identical climate, there’s also a possibility of rebranding. As a result, brick-and-mortar lovers could find themselves in a position where they no longer identify with a casino they used to visit. If customers wish to look at their options and thus find more casino operators, they may consult directories. These comprehensive databases will give you an outlook on all main clubhouses in the country.

CasinoBonusCa

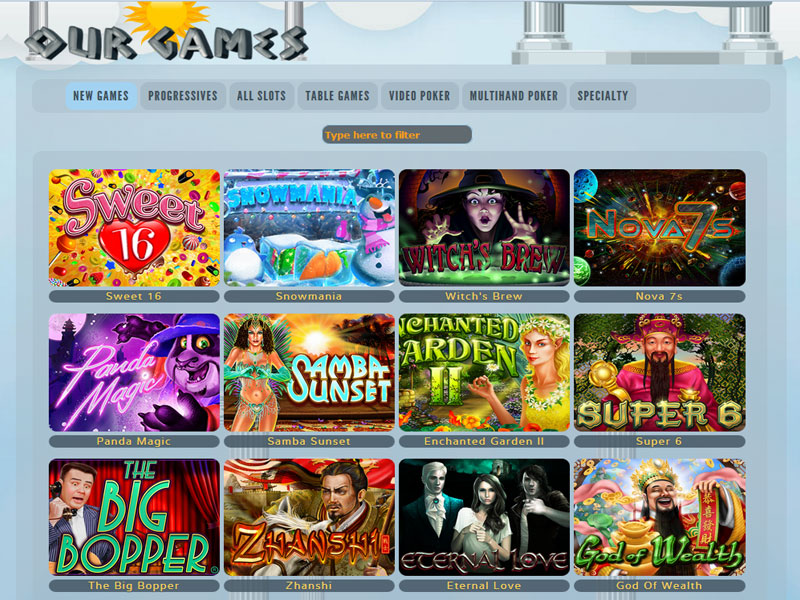

The world wide web becomes easier to surf when a team of experts analyzes the casinos for you. Here, expect to find comprehensive reviews about the products, providers, payment methods, mobile compatibility, and many other fundamental aspects of web gaming. You can head over to CasinoBonusCa where everything you need to know as an Internet player gets covered.

World Casino Directory

This website specializes in land-based locations, although it has a fair share of online addresses, too. Here, you are bound to find the name, operator, and primary characteristics of the casinos that interest you. Furthermore, you’ll find the number of games to play there and even their type. The reviews come from clients who tried the casino experience firsthand.

To make a long story short

The brick-and-mortar industry in Canada is likely to face significant changes. We won’t attribute any connotation to the fact, though we believe that numerous casino resorts will go through a change of face. It is the customer’s best bet to stay informed about the gambling options they’ve got nearby, especially in the volatile world of mergers. This is precisely why we propose a thorough look at databases that contain all the pieces of useful information.

Apollo Casino Coupons

Interesting related article: “What is a Takeover?“